COMING SOON: 4BR 2.5Bath 3500sf Single Family Oasis in Marlborough, MA

Get Ready to Enjoy Summer in this beautiful single family home located on one of Marlborough’s most desirable streets! Just 0.6mi from the pristine Memorial Beach on Meadow Lake, this 3500sf renovated 4BR home with meticulously landscaped yard and heated in-ground pool offers a private oasis

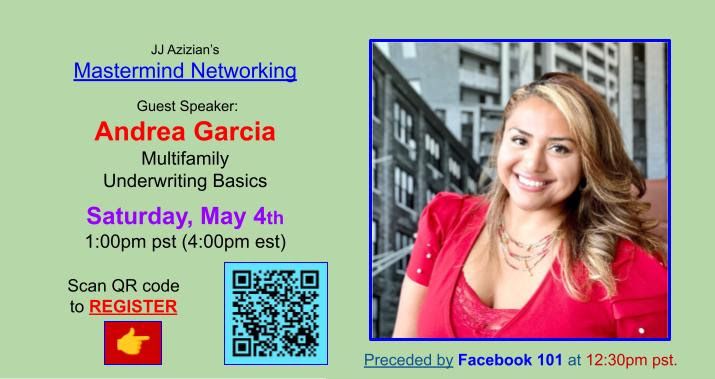

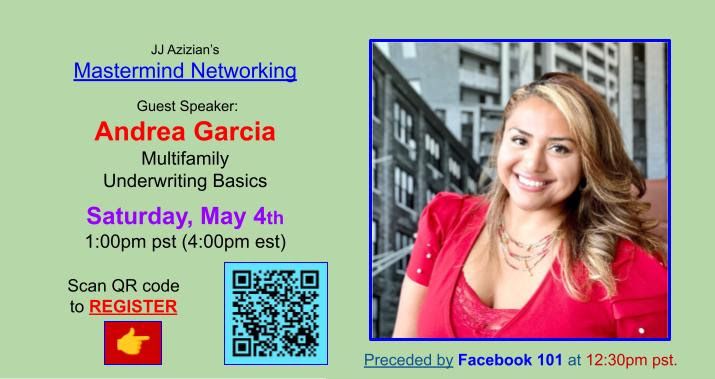

Multifamily Underwriting Basics with Andrea Garcia @ May 4, 2024 @ 4PM EST

Multifamily Underwriting Basics Saturday, May 4, 2024 @ 4PM EST Guest Speaker Andrea Garcia - Multifamily Underwriting Basics with JJ Azizian Sign up for JJ's Mastermind Networking:https://docs.google.com/forms/d/e/1FAIpQLScjh1_AOA_Co7i5jxwzmqp1Yj1DV1tymrn5znKymzVgvtOGow/viewform https://jjaz

"Explain It with Caroline & Ingryd: Matthew Bell Mortgage, Subto, and LENDING to win"

"Are you focused on creative deals but are constantly receiving an objection regarding their DTI (debt to income ratio) so even though they want to sell subject to or on seller financing / carryback, they are hesitant to move forward if it impedes their ability to buy their next home. Matthew Bel

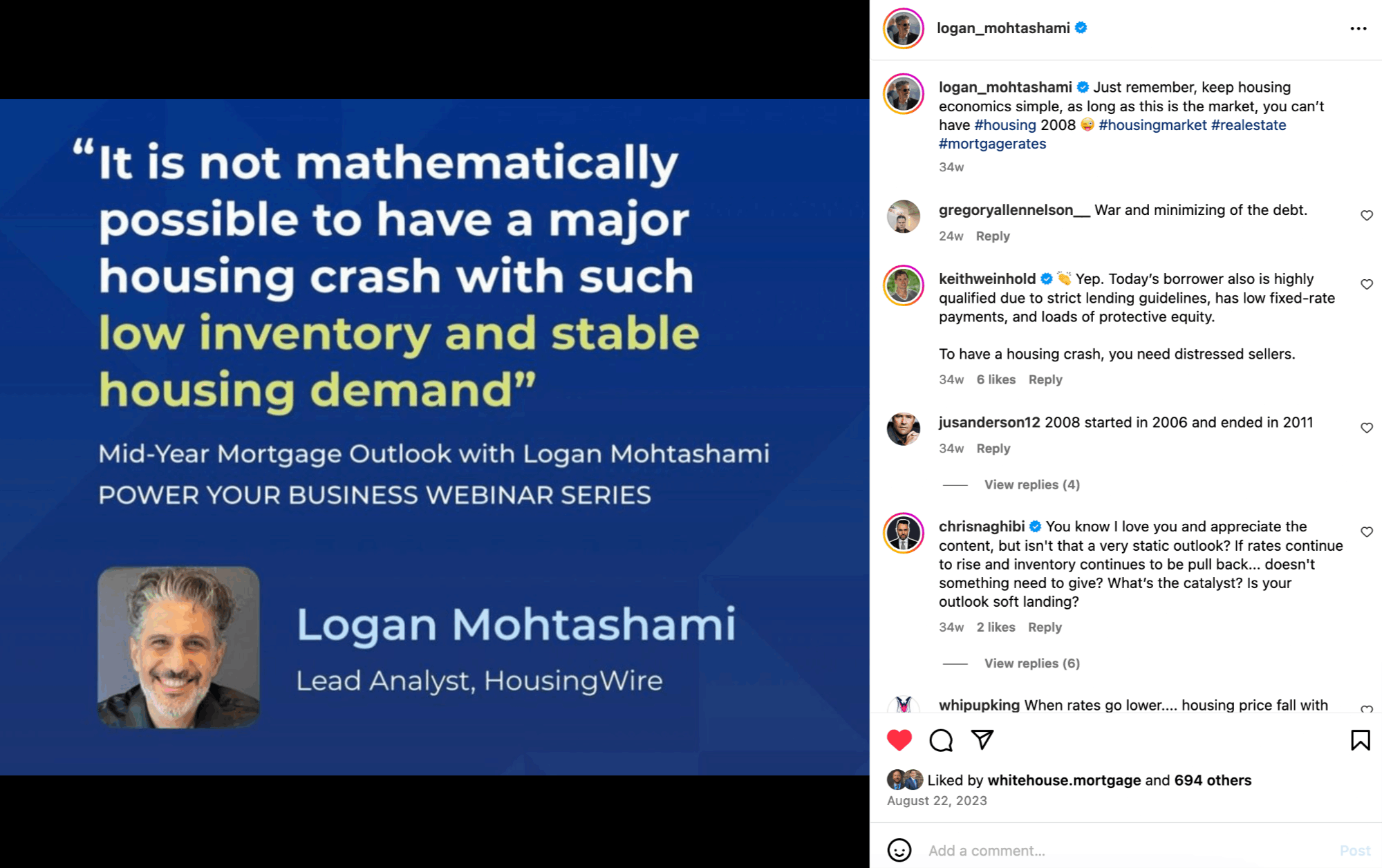

Hunter Thompson: "Could The Fed Lower Rates WITHOUT A Recession?"

Source: https://cashflowconnections.com/could-the-fed-lower-rates-without-a-recession-e841-cfc "Crazy things are happening in the economy… Interest rates were raised faster than they have been in 40 years… Even though the growth rate of inflation is going down… And the Fed has already forecaste

Categories

Recent Posts

GET MORE INFORMATION

Broker Associate | License ID: 9555596

+1(617) 549-5503 | mybostonrealtorkarina@gmail.com